The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. Workers earning less than this limit pay a 6.2% tax on their earnings.

You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Social security max deduction 2025.

The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

What Is The Maximum Social Security Deduction For 2025 Marga Salaidh, In that scenario, workers will pay up to $391 more in social security taxes in 2025. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed.

2025 Social Security Tax Percentage Josey Mallory, In 2025, you can earn up to $22,320 without having your social security benefits withheld. Social security payments are subject to federal income tax in 2025, but only if combined income exceeds certain limits.

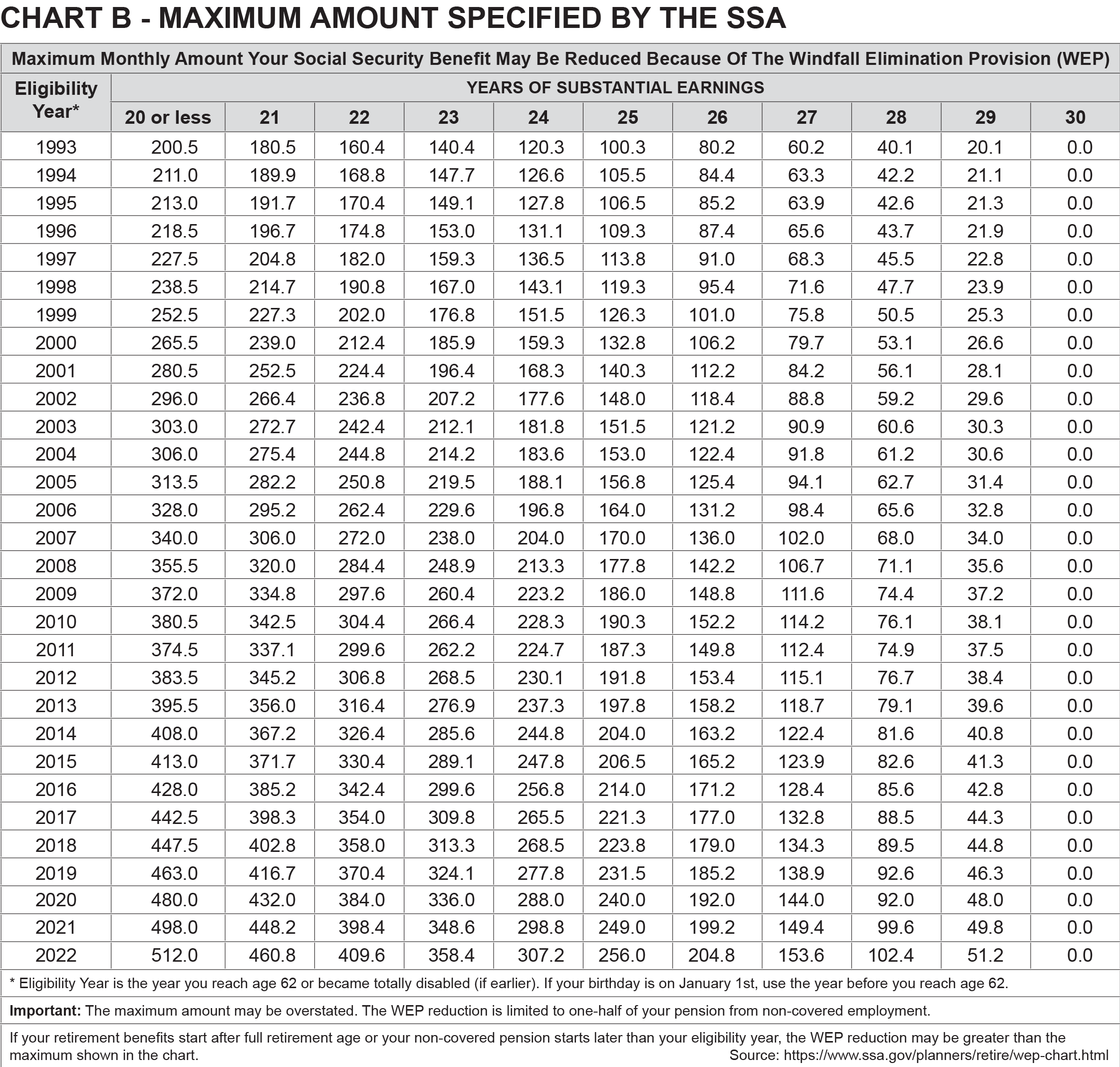

Max Wep Reduction 2025 Lynde Ronnica, For 2025, here's how the age you start receiving retirement benefits factors in. In that scenario, workers will pay up to $391 more in social security taxes in 2025.

Will Social Security Benefits Increase In 2025 Gale Pearla, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. As kiplinger reported, the social security tax wage base jumped 5.2% from 2025 to 2025.

Max Hsa Contribution 2025 Over 50 Dodi Kriste, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed. Up to 50% of your social security benefits are taxable if:

2025 Tax Brackets And Rates carlyn madeleine, (for 2025, the tax limit was $160,200. That's because the irs adjusts the maximum earnings threshold for social security each year.

Social Security And Medicare For 2025 Irena Saloma, The largest ever was 14.3% in the 1980s. Age 65 to 67 (your full retirement benefits age):

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Social security payments are also subject to. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

Social Security 2025 Maximum Raf Leilah, This is an increase from the. For earnings in 2025, this base.

Maximum Taxable Amount For Social Security Tax (FICA), We raise this amount yearly to keep pace with increases in average wages. To elaborate, the tax rate is generally 6.2%, meaning a worker with income.

In 2025, the social security tax limit rises to $168,600.

Bmw 2025 M240i Viknesh vijayenthiran june 12, 2025 comment now!…

June Jam 2025 Lineup All titles will be available starting…

2025 Hyundai Tucson Hybrid Accessories And Accessories Shop 2025 hyundai…